By Paul R Salmon FCILT, FSCM, FCMI

Few terms in supply chain management provoke as much heated debate as “safety stock.” For some, it’s nothing more than an outdated crutch — a costly pile of parts and products sitting idle in warehouses, masking deeper issues of poor planning and weak supplier performance. For others, it’s a strategic necessity — the only way to protect against uncertainty in demand and supply, and the last line of defence against operational failure.

So, which is it? Is safety stock a waste of time, or a necessity? The answer, as with most things in logistics, depends on context, intent, and execution.

What Safety Stock Is — and Isn’t

At its simplest, safety stock is a buffer. It’s the “just in case” inventory that sits behind your forecasted demand, intended to shield your operation against variability. Variability comes in two main forms:

Demand variability: Customers, troops, or consumers ordering more or less than expected. Supply variability: Suppliers delivering late, incomplete, or out-of-spec.

Too often, safety stock is viewed as a crude insurance policy — a percentage added on top of a forecast without much thought. That’s where it becomes wasteful. But when calculated scientifically, aligned to service-level objectives, and actively managed, safety stock becomes a precision tool in the resilience toolkit.

The Case Against Safety Stock

Let’s start with the sceptics’ view. Safety stock can, and often does, become a waste of time and money:

1. It Ties Up Capital

Inventory is cash you can’t use elsewhere. Every unit sitting idle is money frozen, impacting liquidity and opportunity. For organisations under pressure to reduce working capital, bloated safety stock levels are an easy target.

2. It Masks Root Problems

Excessive buffers can hide the real issues in your supply chain — poor data quality, unreliable forecasts, or systemic supplier underperformance. Rather than solving these issues, safety stock can become a sticking plaster that stops leaders addressing root causes.

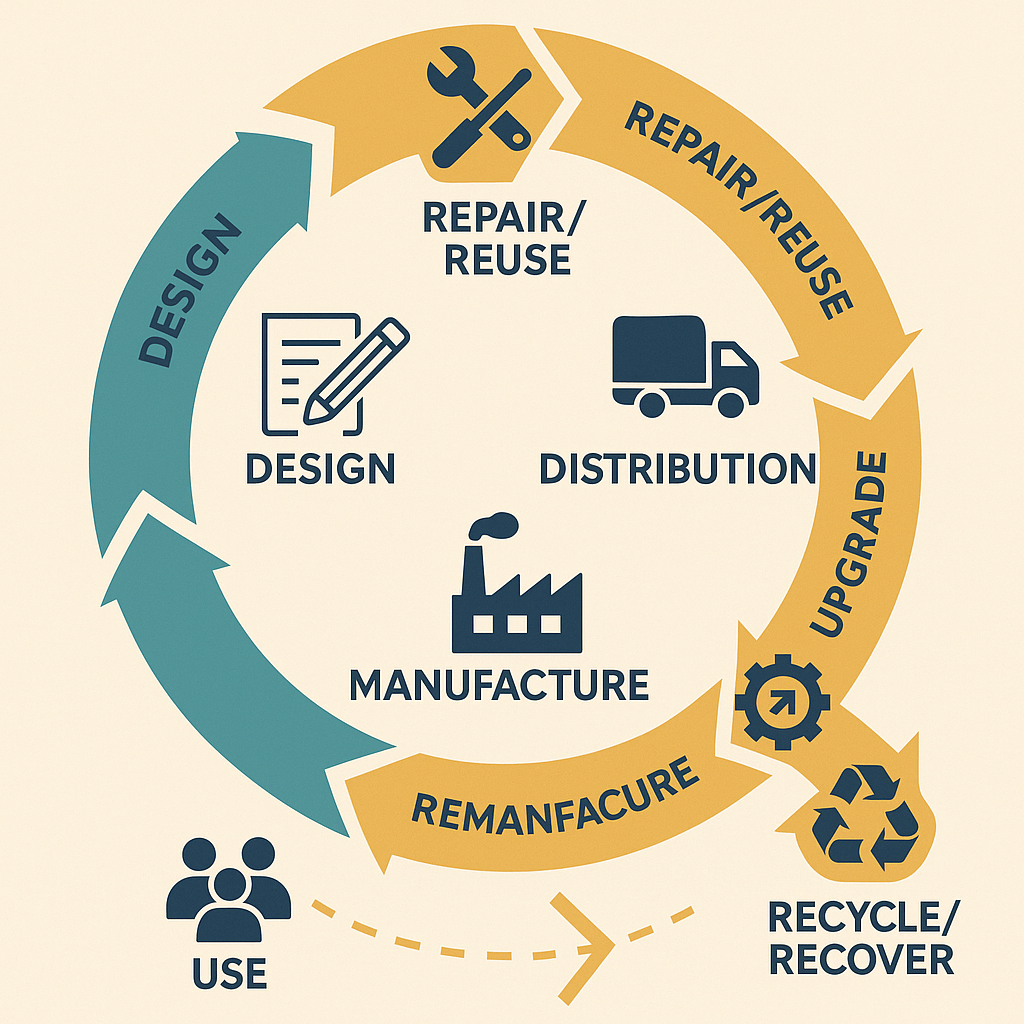

3. It Risks Obsolescence

In fast-changing industries, holding too much safety stock is dangerous. Products evolve, platforms get upgraded, and parts get superseded. Defence supply chains in particular have warehouses full of obsolete stock that once felt “safe.”

4. It Costs to Hold

Carrying costs — warehousing, insurance, depreciation, shrinkage — add up quickly. If the safety stock is not linked to service value, you’re essentially paying for empty readiness.

The Case for Safety Stock

Now, the defence. In the real world, few supply chains operate with perfect predictability. In volatile environments, safety stock is not just necessary — it’s life-saving.

1. Uncertainty is Inevitable

No matter how sophisticated the forecasting model, there will always be events you can’t predict. COVID-19, the Suez Canal blockage, or sudden conflict in Eastern Europe all threw demand and supply patterns into chaos. Without buffers, many organisations would have ground to a halt.

2. Criticality Demands Insurance

For some items, the cost of failure is unacceptable. A spare part for an aircraft, a component for life-support equipment, or a critical pharmaceutical dose — the consequences of stock-out dwarf the cost of carrying stock.

3. Lead Times Are Long

When sourcing involves complex international supply chains, or where Defence deployments extend supply lines into contested environments, replenishment is measured in months not days. In these scenarios, safety stock is not optional — it’s operational necessity.

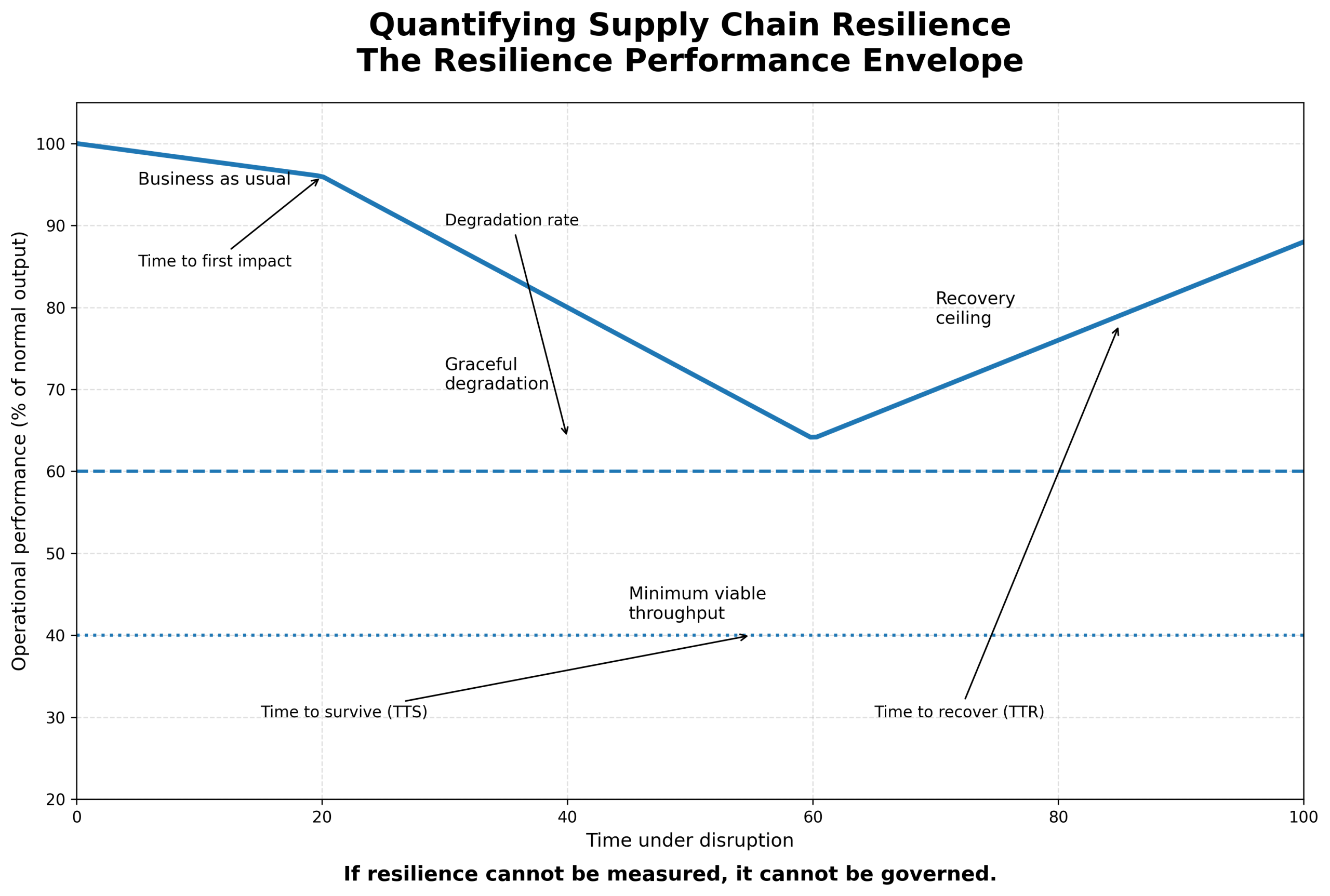

4. Resilience Matters

In an era where supply chains are expected to be both lean and resilient, safety stock provides shock absorption. It gives breathing space to manage disruption while maintaining service continuity.

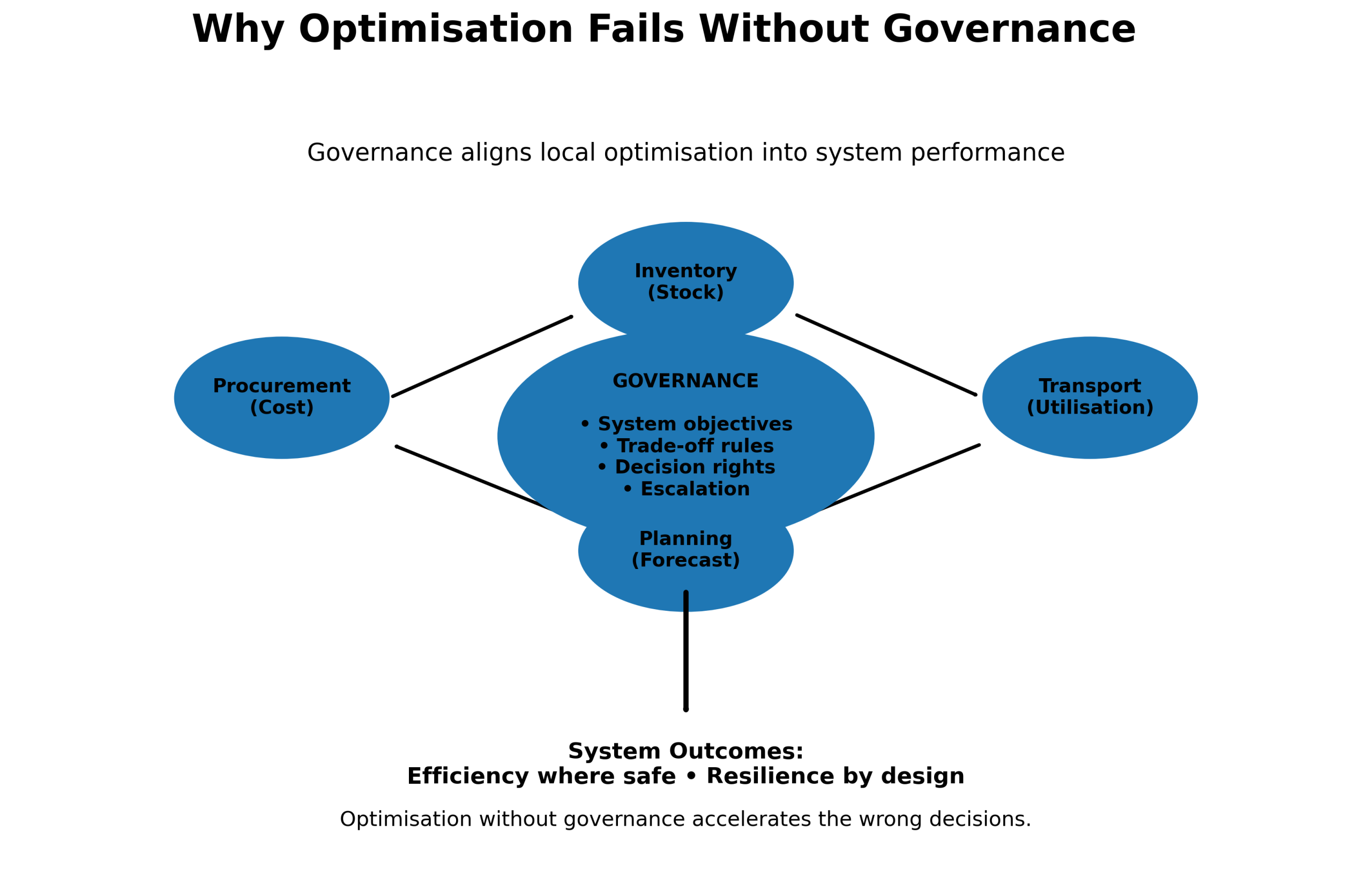

The Balancing Act: Waste vs. Necessity

So, safety stock is neither inherently wasteful nor inherently necessary. It’s a lever. The question isn’t whether to hold safety stock, but how much, where, and why.

The right balance depends on:

Service level objectives: What is the acceptable probability of a stock-out? 95%? 99%? Risk appetite: How much uncertainty can your organisation tolerate? Item criticality: Is this item nice-to-have or mission-essential? Supply chain volatility: How variable are demand and supply signals?

How to Get Safety Stock Right

1. Use Data-Driven Models

Avoid crude “10% extra” rules. Modern approaches calculate safety stock scientifically using demand and supply variability, service-level targets, and lead-time distributions. Simulation tools can go further, stress-testing stock policies under different scenarios.

2. Segment Your Inventory

Not all stock is equal. Apply ABC/criticality analysis. High-value, low-criticality items might need no buffer. Low-cost, high-criticality items might need generous safety stock. Defence often uses war-stock vs. peace-stock to reflect different operating tempos.

3. Continuously Recalibrate

Safety stock is not “set and forget.” As demand patterns shift, supplier performance changes, or operating environments evolve, stock policies must be reviewed. What was appropriate in peacetime may be wholly insufficient in conflict.

4. Integrate with Forecasting

Safety stock should complement, not replace, forecasting. Think of it as the airbag to forecasting’s seatbelt. Both are needed for safety. A strong forecasting process reduces reliance on large buffers, but some buffer will always be required.

5. Align to Risk and Strategy

The conversation about safety stock should start with risk appetite, not warehouses. Boards and commanders need to set clear guidance on acceptable failure risk, which can then cascade into quantified safety stock policies.

Safety Stock in Defence: A Special Case

In Defence, the stakes are higher and the calculus is different. A commercial retailer can afford to lose a sale. A military commander cannot afford to lose readiness. That makes safety stock particularly critical.

War-stock vs. peace-stock: Defence must hold strategic reserves for surge scenarios. These reserves may look excessive in peacetime, but they are vital insurance for warfighting. Distributed operations: Safety stock has to be pre-positioned, often in austere or contested environments where resupply is slow or dangerous. Obsolescence risk: Defence must guard against holding the wrong type of safety stock for platforms that evolve over decades. Budget pressure: Defence leaders face the same working capital scrutiny as industry, so the balance between “just enough” and “just in case” is even more complex.

The Future of Safety Stock

The next frontier is smarter, dynamic safety stock. Advances in AI, digital twins, and supply chain simulation allow organisations to model disruptions in real time and adjust stock levels dynamically. Instead of static policies, we’re moving toward adaptive buffers that flex with conditions.

AI-driven forecasting can reduce uncertainty, lowering safety stock needs. Digital twins of supply chains can test buffer strategies against simulated crises. IoT and visibility tools reduce lead-time uncertainty, allowing leaner buffers.

But even in a digital world, the principle remains: buffers are about risk, not efficiency.

Conclusion: Waste or Necessity?

Safety stock is both — it can be a waste when lazy, and a necessity when strategic. The difference lies in discipline.

When safety stock is an arbitrary percentage, it wastes money, hides problems, and risks obsolescence. When safety stock is scientifically calculated, actively managed, and linked to organisational risk appetite, it is a powerful enabler of resilience and readiness.

Ultimately, supply chain leaders must stop treating safety stock as a blunt instrument and start managing it as a precision tool. In Defence and beyond, the question is not “do we need safety stock?” but “what safety stock do we need, and why?”

Because when it’s the difference between readiness and failure, safety stock isn’t a waste of time — it’s time well invested.

Leave a Reply