By Paul R Salmon FCILT FSCM FCMI

Forecasting has long been the cornerstone of effective supply chains. In the commercial world, it drives everything from manufacturing to retail restocking. But in Defence, the challenge becomes significantly more complex. When the stakes are measured in operational availability rather than profit margins, the question isn’t just can we forecast accurately—but how accurate is good enough to trust?

This article explores what forecast accuracy means in a Defence context, how it can be improved, and what benchmark levels of performance we should realistically aim for.

The Defence Forecasting Challenge

Unlike civilian supply chains, Defence forecasting must operate in an environment shaped by:

Long, uncertain lead times Low volume, high-value, highly specialised inventory Rapid shifts in operational tempo Variable platform usage profiles Geopolitical uncertainty and coalition operations

These factors mean that conventional demand planning methods (which assume stable consumption and short lead times) often fall short. Defence platforms are maintained over decades, often beyond their originally intended life. Many critical components are subject to obsolescence, and usage is non-linear—surges in demand during exercises or operations can dwarf peacetime patterns.

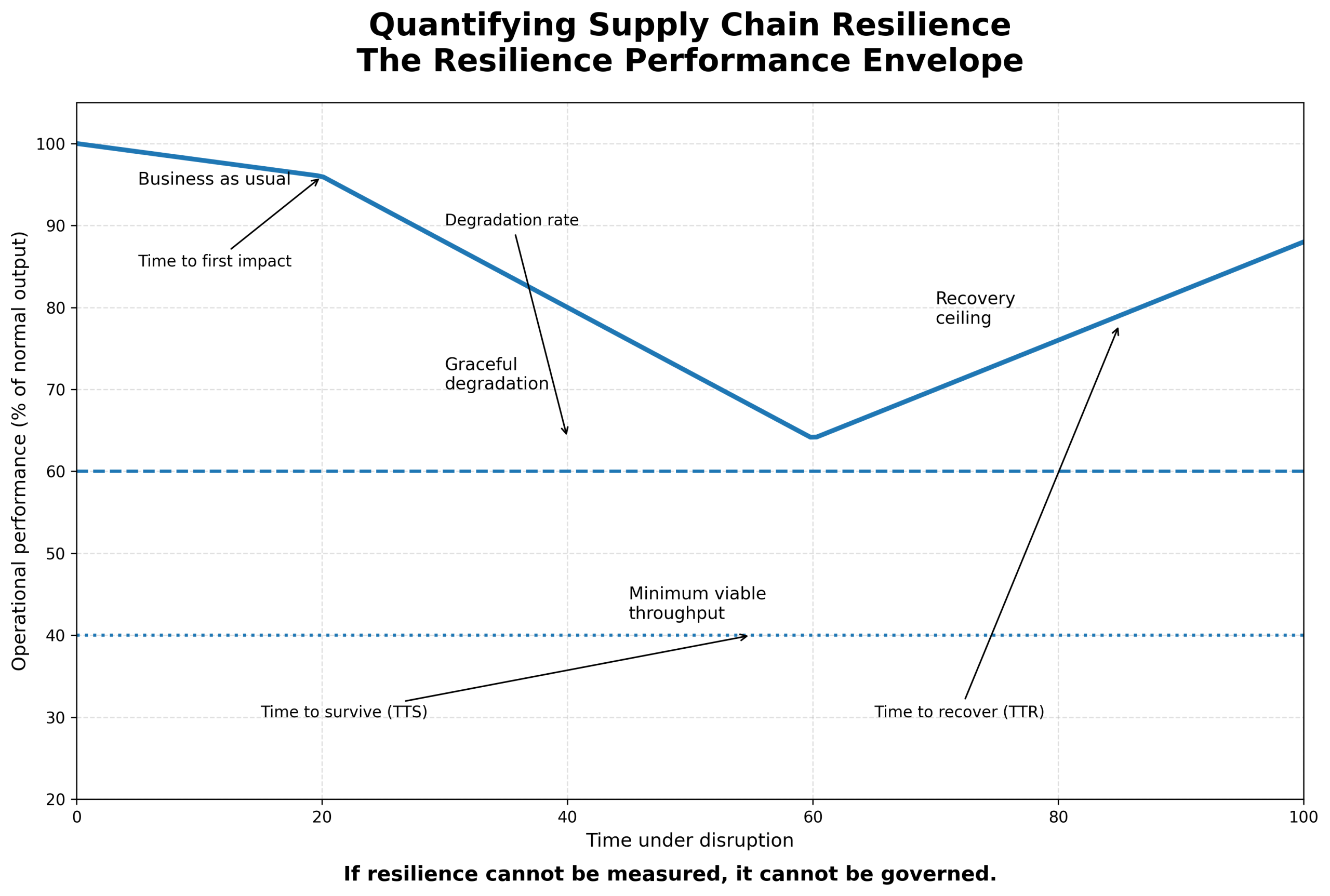

Put simply: Defence doesn’t just need accurate forecasts—it needs resilient ones.

What Does ‘Forecast Accuracy’ Actually Mean?

Forecast accuracy measures how close predicted demand is to actual usage. It can be calculated in several ways—Mean Absolute Percentage Error (MAPE), Forecast Bias, and Forecast Value Add (FVA) are among the most common.

But in Defence, raw accuracy often tells only part of the story. For example:

A 95% forecast accuracy on batteries might be meaningless if a single missed part—like an engine or pump—renders a platform unavailable. Forecasts for parts with low usage but criticality (e.g., mission-essential LRU spares) may be wildly inaccurate due to sparse historic data.

So while percentages help, they must be paired with contextual insight, operational risk, and readiness impact.

What’s a ‘Good’ Forecast Accuracy in Defence?

In commercial sectors like FMCG, forecast accuracy targets of 85–95% are routine. However, these operate under conditions of repeatable, high-volume demand and low uncertainty.

In Defence, different benchmarks apply:

Inventory Type

Typical Forecast Accuracy Range

High-volume consumables (e.g. filters, batteries)

70–85%

Rotables with predictable failure data (e.g. tyres, blades)

60–75%

Rarely used or critical obsolescent parts

40–60%

Obsolescence-prone or ‘no demand history’ items

< 40% (forecasting less valuable than risk planning)

Anything above 60% across Defence inventory portfolios—especially where complexity, coalition interdependencies, and operational uncertainty are high—is a commendable achievement. In some cases, Forecast Value Add (FVA) becomes a more useful metric: does the forecasting process materially outperform a naïve baseline (e.g. “last year’s demand”)?

How to Improve Defence Forecasting

Accuracy isn’t a guessing game. It’s the result of joined-up processes, high-quality data, and the right modelling tools. Key levers include:

1. Better Data Quality

Poor inputs deliver poor outputs. Forecasting depends on accurate:

Failure rates / Mean Time Between Failures (MTBF) Lead times (procurement and repair) Historical usage across platforms and locations

This requires stewardship of Critical Data Elements (CDEs) and robust support modelling.

2. Scenario-Based Forecasting

Rather than a single-point estimate, use scenarios:

Routine peacetime use High readiness posture Coalition-led surge demand Contingency (e.g. humanitarian or expeditionary missions)

This enables planners to make risk-informed inventory decisions—not just best guesses.

3. Modelling Supply Chain Constraints

Forecasting cannot ignore capacity:

Will items arrive in time? Are warehouse and transport routes able to cope with surges? Do I have contractual access to industrial repair slots or manufacturing throughput?

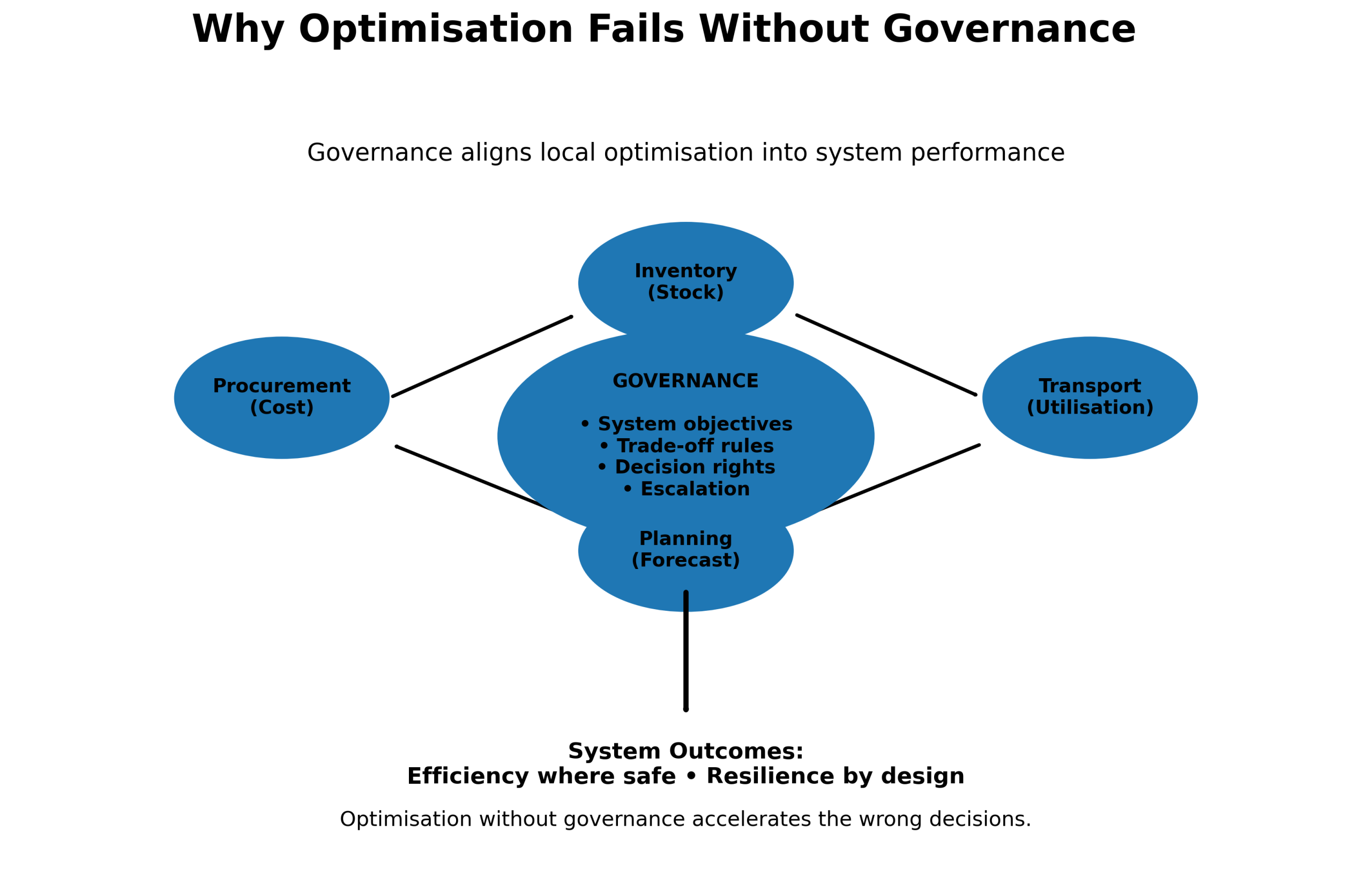

4. Joined-Up Profession

Forecasting cannot be siloed. True forecast accuracy requires:

Engineering (failure and usage modelling) Commercial (contractual responsiveness and lead time risk) Logistic planners (demand and distribution modelling) Operations (platform tempo and tasking visibility)

Creating a common language and shared toolset between these actors is essential.

5. Use AI and Predictive Analytics – Carefully

AI tools like demand sensing and probabilistic forecasting are game-changers—if built on a solid foundation of data quality and interpretability. Defence must not be dazzled by automation that can’t explain its rationale.

Final Thought: Don’t Let ‘Perfect’ Be the Enemy of ‘Operationally Useful’

Defence will likely never achieve 95% forecast accuracy across all items. And that’s okay.

Instead, the goal should be:

To be better than baseline To understand the risks and trade-offs in forecast variance To focus accuracy efforts where it matters most (e.g., high readiness fleets, strategic platforms, mission-critical components) To measure forecasting value not just forecasting precision

If Defence invests in the right tools, data stewardship, and collaborative culture, it can shift forecasting from a fragile guess to a foundation of logistics agility and strategic advantage.

Leave a Reply